There is no doubt that the pandemic era has caused an economic downturn - now evident in the surge in business failures, particularly within the construction sector.

With the pandemic support schemes coming to an end, there is an imminent fear that there will be further downfall impacting already struggling businesses, which will in turn see a rise above pre-pandemic insolvency levels.

The surge in the number of business failures has reached a two and a half year high, with the largest increase in administrations over the past 12 months being within the construction industry, as companies respond to supply shortages and inflation of materials amongst other concerns.

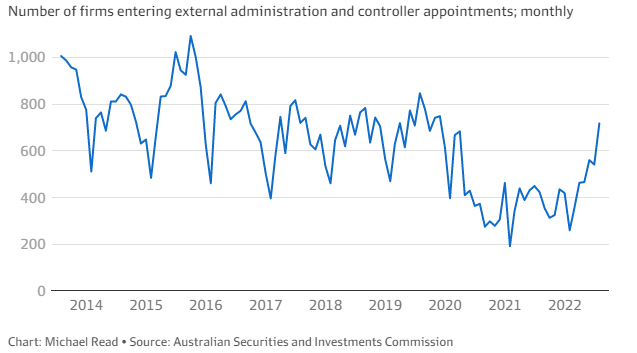

The table below shows the number of firms entering administration:

It is clear that the number of companies entering external administration is creeping up to the pre-pandemic highs of 2019.

The decrease between 2020 – 2021 is a result of the various Government policies (such as JobKeeper), and the temporary changes to insolvent trading laws which allowed some businesses to keep their heads above water.

The alarming increase in the number of construction sector insolvencies has caused the Albanese Government to direct an overdue in-depth inquiry into Australia’s corporate insolvency laws, noting that a substantial review has not been conducted in over 34 years.

Some of the concerns that the inquiry will consider include:

- Recent and emerging trends in the use of corporate insolvency in Australia. This includes the temporary pandemic insolvency measures, as well as recent changes in domestic and international economic conditions (i.e. inflationary pressures, supply shortages etc.);

- The operation of the existing legislation and regulatory arrangements;

- Other potential areas for reform (including unfair preference claims, insolvent trading safe harbours etc.);

- Supporting business access to corporate turnaround capabilities to assist in managing financial distress;

- The conduct of corporate insolvency practitioners;

- The role of government agencies in the corporate insolvency system i.e. ASIC and the ATO.

The Albanese Government’s intention behind the inquiry is to establish new ways to assist financially distressed businesses without placing further financial burdens, and to ensure that insolvency is being utilised as a matter of final measure and only in the most necessary circumstances to see that viable businesses remain solvent.

If you have a query relating to any of this information, or would like to speak with Holman Webb's Commercial Recovery and Insolvency Group in relation to a matter of your own, please don't hesitate to get in touch today.